With technology on the rise and all the talk about money being decentralized, apps like klarna are getting a lot of attention. Kla5rna, for those of you who dont know, is an app, that works on the buy now pay later scheme. It is a form of credit where you don’t have to pay interest if you give them the money back in their given period. With the help of such schemes, buying expensive products has become easier, faster, and way more efficient.

And since all of your money is not channelized into one thing only, you have leftovers for emergencies. However, instead of giving you a finance lesson, let us give you en more apps like klarna, that work on the same basic principle of buy now and pay later, but each has its unique attributes. So if that sounds interesting to you, then let’s hop right into it:-

Here is the list of the 10 best apps like klarna to Use in 2022.

Afterpay

Afterpay is one of the most famous applications in the domain. With more than hundreds of thousands of active users, afterpay is the largest in the sector. However, what afterpay does best is that it gives you the simplest interface transfer money. Say, for example, you need to buy a new dishwasher, however, you dont want to pay all the money upfront. Aferpay lets you pay your bill in four installments that are due every two weeks.

As long as you pay them within this time frame, there are no chargeable interests and hence you walk with an easy and efficient method of purchasing. This also makes sure that there is no full commitment to the product you’re buying because there are still installments for you to pay.

Unlike credit card companies, afterpay gives you a 2-month interval to pay your dues, which is more than enough. Also, comparing afterpay to other such apps in the market, it’s the fastest. There are a lot of approvals needed on other apps, which afterpay takes care of and hence gives you the greatest service ever. If you have not tried aferpay yet, then you must as this is the new way to shop.

Paypal credit

Many of you may be familiar with Paypal as an application that is internationally used for making purchases and money transfers. However, there is a new service from them in the market. It’s called PayPal credit and it is also based on the same system of buy now and pay later as the other apps mentioned here. However, PayPal is a much better-known app for money transfers and hence is highly credible as well.

Also, the best thing about PayPal credit is that you get a 6 month period to settle your scheduled dues when you purchase anything worth more than $99. However, they do apply late fees whenever you miss your deadlines, but as long as you pay them in time there are no interests. If you’re looking to transact effectively in this modern-day world, then PayPal credit is a must-use app. Also, it is better than klarna in terms of its interface and security policies, which makes it perfect for beginners as well.

Laybuy

The next app on the list is laybuy. Laybuy is also a similar application, with similar use cases. You can use it to purchase anything from the accepted stores, both online and offline. They divide your bill into six easy installments spread over a six-week time interval. The first fraction of the money would be paid on checkout and the rest later, as scheduled. The best thing about layup is that you dont have to worry about forgetting cash or a card.

All you have to do is open the app, and checkout with their app balance. However, one thing to be aware of before using layup is that they do require your credit card information before registering, which might affect your credit score. Laybuy is the perfect application for people who are usually forgetful and would like a simpler method to transact. If you’re one of those, then laybuy is the app for you.

Affirm

The next app on this list is Affirm. Unlike the other payment apps we just mentioned, affirm does not have a zero percent interest rate. But dont be heartbroken already because affirm has a lot more to offer. With Affirm you can get longer loan periods for larger amounts of money.

You can buy from 6500 merchants affiliated with them and hence is the perfect place for you to sign up. Also, there are no late, service, or prepayment fees to worry about, so signing up is the easiest. Speaking of which, the interface of the app is very simple as well, which makes it possible for you to manage your payments better and also keep a track of your money. With affirm, you can also take short-term loans, which can be paid within a six-week interval.

Also, you can take a longer payment duration, but then the interest rates vary. Speaking of which, they lend out money with a varying interest rate of 0-30%, based on which store you buy from. However, they also give special discounts on select brands, so you can shop without worries. If you haven’t used affirm yet, we highly recommend doing so.

Zip

The next app we have on this list is zip. With pretty much the same utility as the other apps mentioned on this list, zip makes your transactions easier and way quicker than usual. Zip, formerly known as quad pay divides your bill into four installments, which have to be paid over the next six weeks of purchase. Now, there is no signup or registration fees, but you have to pay one-fourth of the money when checking out.

Also, as long as you’re within the given time limit, there are no interests in your purchase, however, if you fail to pay the dues, you will be imposed late fees, which is pretty high. However, a six-week time interval is long enough to pay the remaining three installments, making it way easier for people to buy more expensive items without going all in. if you have not used zip yet, then we highly recommend doing so.

Sezzle

Sezzle is also an app like klarna that can help you pay more effectively with its buy now and pay later scheme. It is an app that can be used both in-store and online which makes it versatile and perfect for people who are always forgetting to bring cash to stores. Just like zip, sezzle also divides your payments into four easy installments, that are applied with zero interests, if you’re able to pay within six weeks.

The first fraction of the amount has to be paid on checkout and the rest three are divided over two-week intervals. Sezzle is a great app because it offers a lot of discounts and offers with the brands it has integrated with, which makes it perfect for going on a shopping spree. But do keep in mind that you have to pay it all back once you’re done shopping, which a lot of people dont realize. However, if you’re using it smartly sezzle can become a great tool to aid your payments in a long run.

Zebit

The next app on the list is pretty much like klarna and the other apps mentioned here. Zebit is an application that allows its users to shop to their heart’s content without them worrying about any hidden fees or registration fees as well. Zebit allows you up to $2500 of credit without any interests attached to it, which makes it perfect to make expensive purchases. As long as you’re on time with the dies, Zebit will not charge any late fees.

Also, Zebit is great because, the brands that it has partnered up with give its users a ton of offers and deals to work with, which is perfect for any average shopper. If you’re looking for an app like klarna, which has a higher credit level, without affecting your credit score, then Zebit is the app for you. If you haven’t even heard of it, we highly recommend installing it yourself and checking it out.

Futurepay

Unlike other apps mentioned here, futurepay lives up to the name. As it suggests, you dont have to pay even a penny on purchase, which perfectly fulfills the buy now and pay later criterion. Futurepay will pay for your purchase in full at the time of checkout and will give you easy installments to pay it back. This sounds a lot like the credit card thing right? well, not exactly. Futurepay does not charge any interest on your purchase, over a given time interval, which is perfect because credit card companies do.

If you’re looking to buy something, but you dont have enough capital yet, then futurepay is the perfect app for you. As they have a higher credit limit, better security, and way more credibility in the market, you can benefit from futurepay. This is why we highly recommend you to use futurepay for all your purchases. It is one of the best alternative to apps Like Klarna.

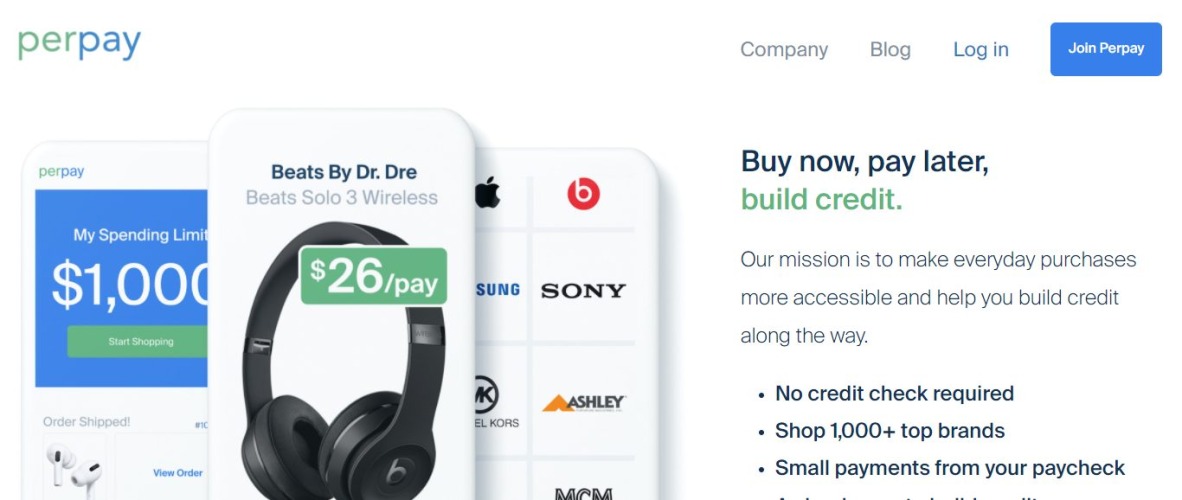

Perpay

Perpay is also among another apps like klarna, but with a very different approach than the others. It is an app that is perfect for people who wouldn’t like the buy now pay later apps to affect their credit scores. Perpay will assign a credit value to your account which will gradually increase as you start using their app for more purchases.

However, unlike other apps, Perpay requires a direct payroll deposit, which means it will automatically debit the installment amount from your paychecks. This is great because you dont have to worry about them harming your credit score, which in turn can affect your finances. If you haven’t used their app yet, it’s great, you must try it once at least.

Four

The last app on the list is four. Just as the name suggests, four is an application that divides your amount to be paid in four easy installments, which you can pay over a six-week time interval. Also, there are no hidden fees or sign-up fees as such, so it’s perfect for beginners. Since a lot of people struggle to make bigger purchases, four helps them divide their amount into four installments and then pay it weekly.

This has made a lot of people have more buying power, which is in turn good for the economy. Before we delve further into economics, let us tell you that four does not charge any interest on your payments either. If you dont make payments timely, however, you will have to pay interest, which is decently high. If you like how klarna works, then we’re sure, four will also be of interest to you.

Conclusion

The above-mentioned ten apps are the best apps like klarna hat are credible and reliable. If you want to make your transactions smarter, then we highly recommend using these above-mentioned apps. We’re sure you will find great benefits from using them. Till then, keep scrolling!